Playground for creative people.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

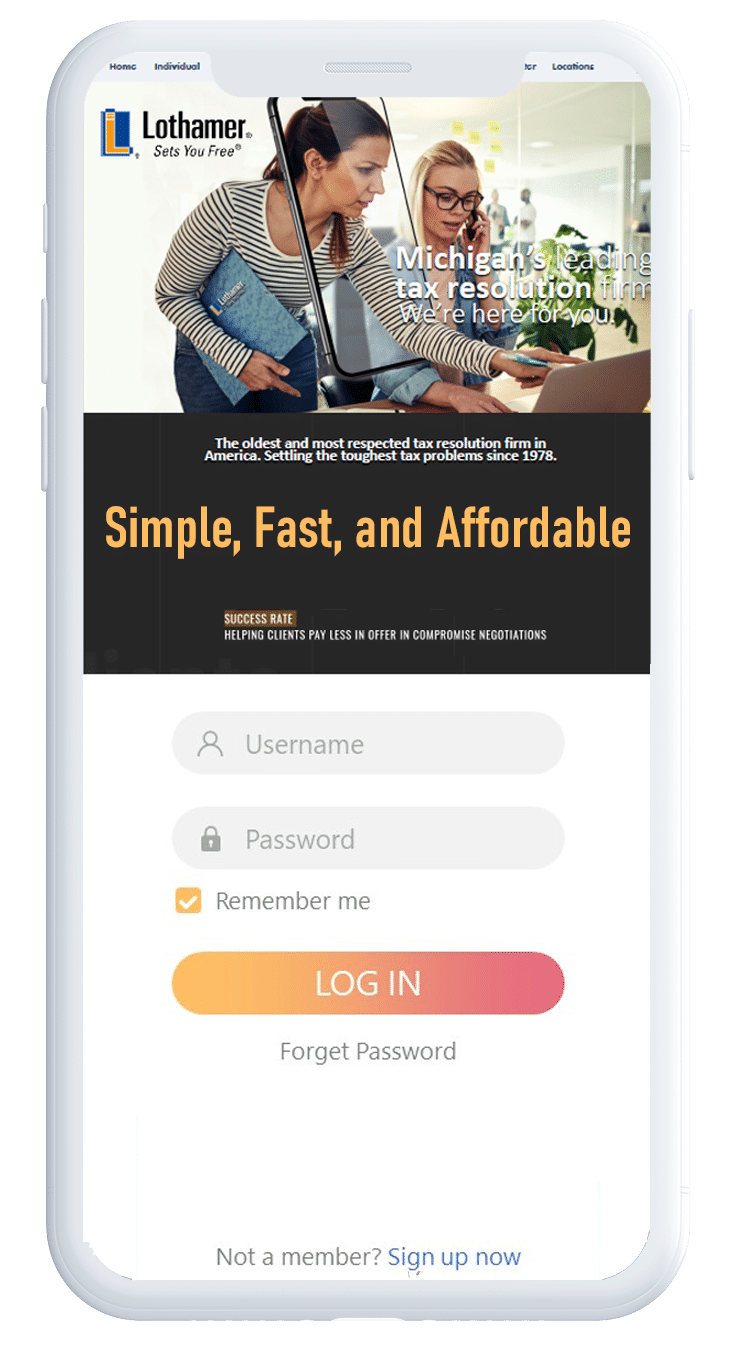

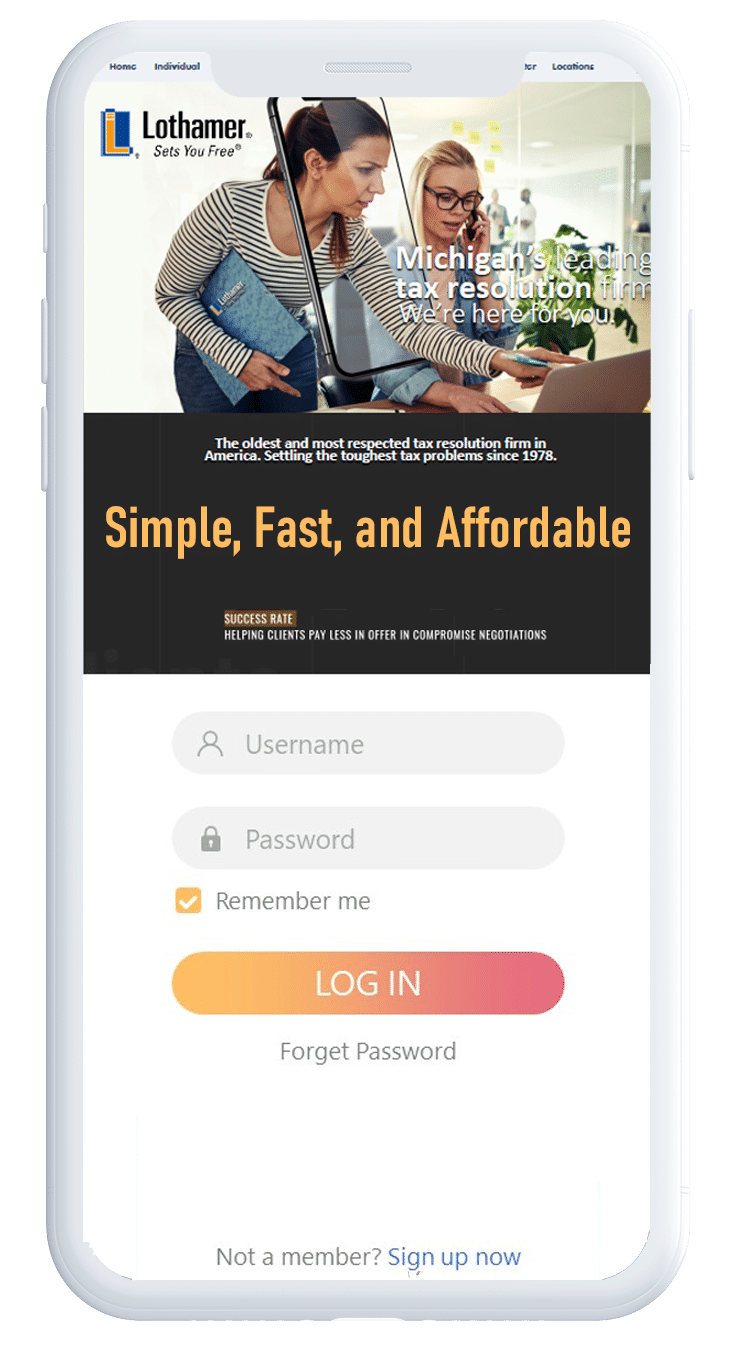

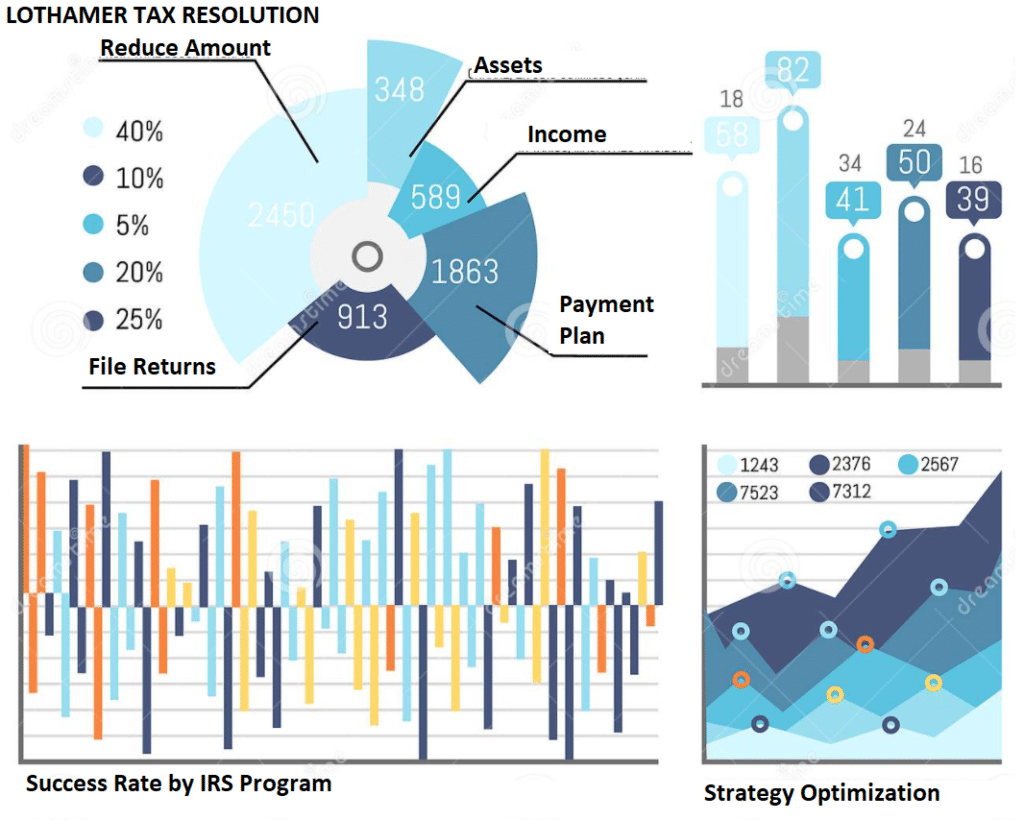

The Lothamer Advantage® gives you the industry's highest level of success. Get there faster with Lothamer.

Lothamer® can step in as your tax representative to help protect and negotiate on your behalf.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

From day one you'll be working with the industry's best tax resolution experts. We've seen it all, from receipts in shoeboxes to no files at all.

The data we pull from the IRS is used in our IRS Success Simulator® to identify your chances of succeeding.

We start by understanding your unique situation and pulling IRS transcripts to know exactly what the IRS knows about you.

Lothamer IRS Average

Success Rate Acceptance

93% 32%

Take control, move forward

Put a stop to collections

We're ready to help

Never worry about late filings.

Payment, Filing, always on time.

Eliminate possibilities for penalties.

Special client-only invitations.

Since 1975 Lothamer has been settling the toughest tax problems. Lothamer Tax Resolution is a national tax firm of Enrolled Agents, who are also Tax Attorneys or Certified Public Accountants (CPAs), specializing in tax representation and tax problem resolution.5

I couldn’t leave my house but Lothamer was there for me always. It was so easy to connect face-to-face even when we couldn’t be in the same room. One click and we were talking! Thank you Lothamer!