101 E Mishawaka Ave

Mishawaka, IN 46545

877-472-0021

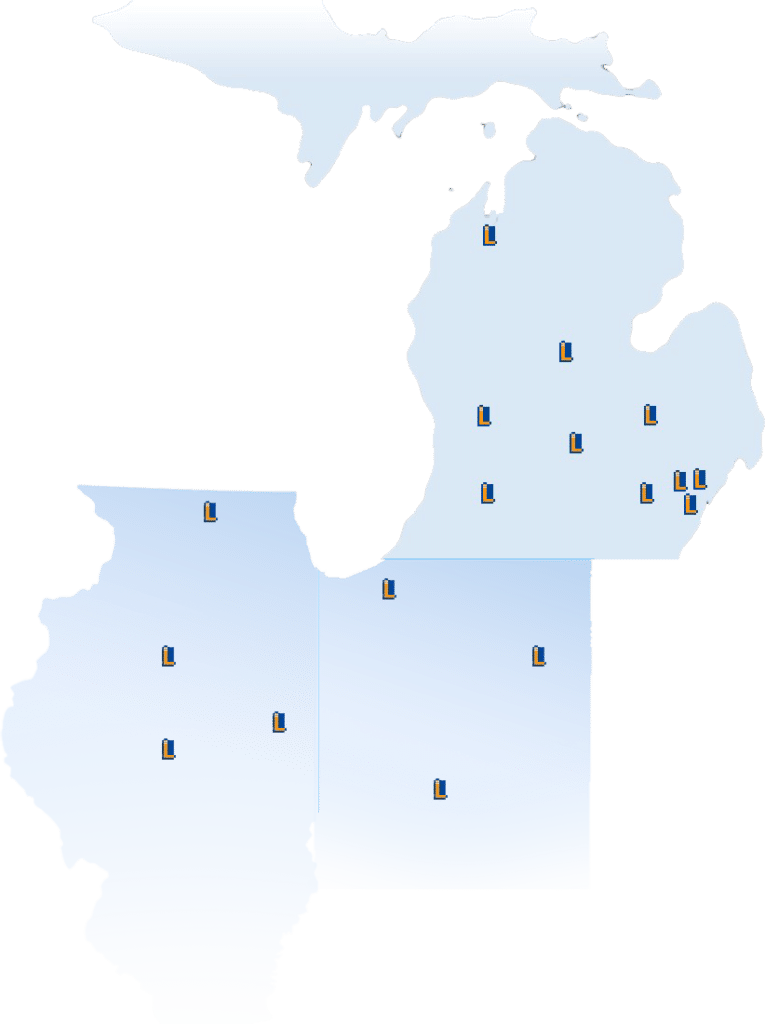

We are the leading tax resolution firm in Northwest Indiana, representing businesses and individuals in South Bend, Elkhart, and the surrounding areas. Our team of Enrolled agents, CPAs, and tax attorneys Since our beginnings in 1978, Lothamer Tax Resolution has saved millions on taxes owed for both businesses and individuals alike. It all starts with a call or email – get the tax help you need to get back on your feet and settle your debt or tax problem once and for all.

Since our beginnings in 1978, Lothamer Tax Resolution has saved millions on taxes owed for both businesses and individuals alike. It all starts with a call or email – get the tax help you need to get back on your feet and settle your debt or tax problem once and for all.